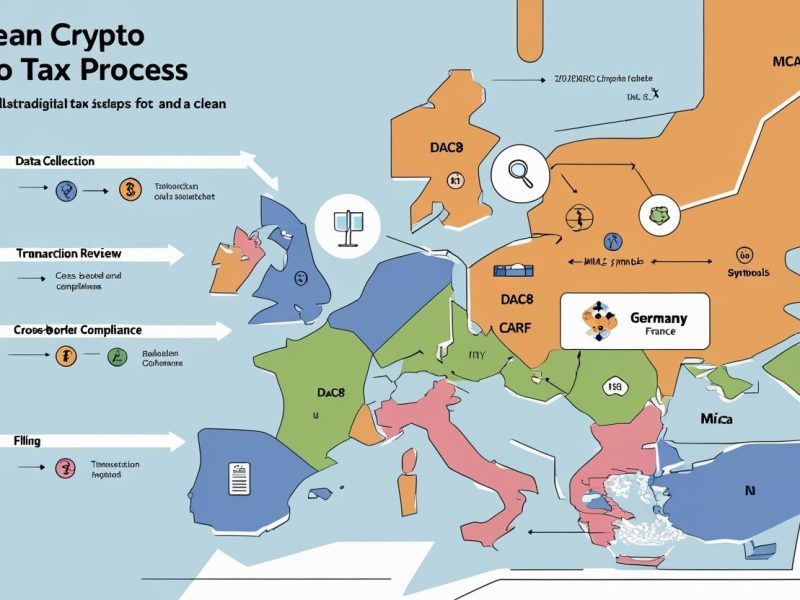

How Our Crypto Tax Accountant Europe Works Step by Step

Step 1: Data Collection

Your Crypto Tax Accountant Europe gathers wallet and exchange data.

Step 2: Transaction Review

Our European crypto tax advisor classifies income, losses, staking, DeFi, and NFTs.

Step 3: Cross-Border Compliance

We manage cross-border crypto taxation Europe and check DAC8 rules.

Step 4: Regulation Alignment

A MiCA compliant crypto tax advisor Europe ensures reports meet MiCA and CARF standards.

Step 5: Filing & Advisory

Final reports are filed by a Crypto Tax Accountant Europe, with advice for future savings.